The adoption of APIs in cryptocurrency trading has revolutionized how traders interact with exchanges. A crypto API trading platform enables traders to execute transactions programmatically, automating repetitive tasks and offering precision in decision-making.

Crypto API Trading Explained

An API (Application Programming Interface) serves as a bridge between a trader and a cryptocurrency exchange. It allows traders to programmatically access exchange functionalities such as placing orders, monitoring market data, and managing account balances.

By using an API, traders can implement custom strategies, automate transactions, and even integrate third-party tools for advanced analytics. These functionalities have made API trading crypto a preferred approach for individuals and institutions aiming to streamline trading operations.

Advantages of API Crypto Trading

Here are the benefits you get when integrating APIs in trading:

- Automation - APIs allow traders to automate tasks such as order placement, portfolio rebalancing, and stop-loss execution. This reduces the need for manual intervention, ensuring efficiency and responsiveness to market changes.

- Faster execution - In volatile markets like cryptocurrency, speed is crucial. APIs provide faster order execution than manual trading, helping traders to capitalize on time-sensitive opportunities.

- Access to real-time data - APIs provide real-time data feeds directly from the exchange, offering up-to-the-minute insights for more informed trading decisions.

- Customizable strategies - Traders can design and implement their algorithms tailored to specific market conditions, maximizing profitability and minimizing risks.

- 24/7 monitoring - With an API, traders can set up systems to monitor markets around the clock, ensuring they do not miss critical market movements even when offline.

Risks of Using Cryptocurrency Trading API

Consider these factors before using APIs:

- Security vulnerabilities - Using APIs involves sharing sensitive information such as API keys. If these keys are compromised, attackers can gain unauthorized access to accounts, posing a significant financial risk.

- Over-reliance on automation - While automation is an advantage, it can become a liability if poorly coded algorithms execute unintended trades during market volatility.

- Technical failures - Network issues, server downtimes, or bugs in the trading system can lead to missed opportunities or unintended losses.

- Inadequate risk management - Automated systems may overlook market nuances that a human trader might detect, increasing exposure to losses during unforeseen events.

- Compliance risks - Different exchanges enforce varying API usage policies. Non-compliance with these guidelines may lead to account restrictions or penalties.

To reduce these risks, traders should implement robust security measures, thoroughly test their strategies, and stay informed about exchange policies. By balancing the benefits and risks of API trading crypto, traders can optimize their operations and maintain a competitive edge in the cryptocurrency market.

If you found this article helpful, we encourage you to share it on your social media platforms—because sharing is caring! For more information about article submissions on our website, feel free to reach out to us via email.

Send an emailWritten by RGB Web Tech

Latest Technology Trends

Latest technology trends shaping the future, including AI advancements, blockchain innovation, 5G connectivity, IoT integration, and sustainable tech solutions. Explore breakthroughs in quantum computing, cybersecurity, augmented reality, and edge computing. Stay ahead with insights into transformative technologies driving innovation across industries and revolutionizing how we live, work, and connect.

Related Articles - Technology

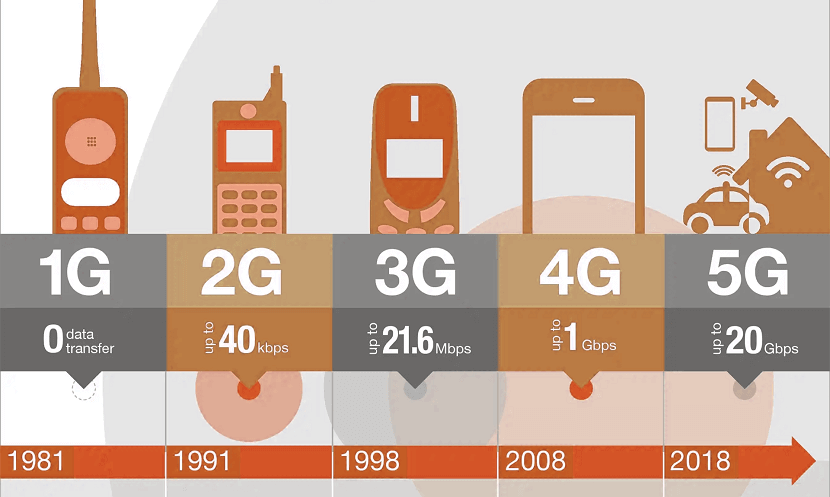

What is 5G Network

What is 5G? Learn everything you need to know about 5G technology and how it will redefine communication, entertainment, and the way people connect ...

Employee Monitoring Software

Enhance productivity and security with SentryPC, the top-rated employee monitoring software trusted by businesses worldwide.

Benefits of Accounting Standards

Enhance your financial management with 7 effective strategies to maximize the advantages of your accounting system. Elevate your business today!

Artificial Intelligence Slides

Unlock AI's power in your digital marketing narrative with dynamic slides. Craft compelling stories that captivate your audience.

AI Content Detection Tools

Discover top AI content detection tools of 2024! Enhance security and streamline content moderation with cutting-edge solutions.

Challenges are Associated with Generative AI Testing

Explore the intricacies of testing Generative AI: Uncover challenges in navigating complexity. Decode the hurdles in ensuring robust AI model evaluations.

Role of Data Science in Business Intelligence

Unlock business potential with Data Science! Explore its pivotal role in Business Intelligence & decision-making. Transform data into actionable insights.

Role of Snowflake Optimization in Business Success

Unlock business success in the data revolution with Snowflake Optimization. Navigate data challenges seamlessly for unparalleled efficiency and growth.

AI Tools for Teachers and Educators

Discover 3 essential AI tools empowering educators: From grading assistance to personalized learning, streamline teaching tasks effortlessly.

Common Myths and Misconceptions About ITIL Debunked

Unravel ITIL myths! Discover truths behind common misconceptions. Unveil the real essence of ITIL in this eye-opening debunking journey.

Strategic Sales Insights

Gain strategic sales insights for navigating today's business landscape effectively. Unlock success with actionable tactics and expert guidance.

Enhancing Virtual Engagement Leveraging Technology for Smooth Interactions

Discover how to enhance virtual engagement by leveraging technology for seamless interactions. Boost connectivity and collaboration in your digital spaces.

The Future of Business Messaging Trends and Technologies

Explore the future of business messaging with insights on emerging trends and cutting-edge technologies shaping communication and collaboration.

Transforming Retail Spaces with Interactive Digital Signage

Revolutionize retail with interactive digital signage: enhance customer engagement, boost sales, and create immersive shopping experiences.

Unlocking User-Centricity with Generative AI

Explore how generative AI is transforming user-centric design, enhancing personalization, boosting engagement, and revolutionizing digital experiences.

Exploring Python Through Mobile Applications

Power of Python on the go! Learn coding, build apps, and explore Python programming through innovative mobile applications.

How an AI to Human Text Converter is Revolutionizing Communication

Discover how AI to Human Text Converters are transforming communication with natural, engaging language for businesses and individuals.

Benefits and Risks of Using API for Crypto Trading

Benefits and risks of using APIs for crypto trading, including automation, efficiency, security concerns, and market volatility

Top Benefits of Omnichannel Contact Center for Agencies

Discover how an Omnichannel Contact Center enhances customer satisfaction, streamlines communication, and improves efficiency for tech and digital agencies.

Revolutionizing Customer Support with Call Center Software

Discover how call center software enhances customer experiences, streamlines operations, and fosters innovation in the ever-evolving web industry.

Boost Scalability with CCaaS for Growing Businesses

Discover how CCaaS enhances scalability, enabling businesses to handle rapid growth, improve web performance, and optimize operations effortlessly.

Enhancing Web Tech Solutions with Contact Center

Discover how a contact center improves web technology, creating seamless, customer-focused solutions that enhance user experience and satisfaction.

Boost Customer Retention with Omnichannel Contact Center

Explore how an omnichannel contact center enhances customer retention for web-based businesses by delivering seamless and personalized experiences

Differences Between Nearshore and Offshore Java Application Outsourcing

Discover the key differences between nearshore and offshore Java application outsourcing, including cost, communication, and time zone benefits.

Innovative Ways AI is Transforming Everyday Life

Discover how AI is revolutionizing everyday life, from self-driving cars and healthcare robotics to smart homes and energy optimization. Explore real-world AI applications driving change.

How to Set Up Your Own WhatsApp Chatbot in Minutes

Learn how to set up your own WhatsApp chatbot quickly and easily in just minutes! Streamline communication and boost engagement effortlessly.

“Technology is best when it brings people together.” — Matt Mullenweg